Tax tables 2022 calculator

A sales tax table is a printable sheet that you can use as a reference to easily calculate the sales tax due on an item of any price - simply round to the. We can also help you understand some of the key factors that affect your tax return estimate.

What Are Marriage Penalties And Bonuses Tax Policy Center

Income tax rates are the percentages of tax that you must pay.

. New Look At Your Financial Strategy. Use our free online personal income tax calculator to work out your estimated monthly take-home pay in SA view income tax tables for the 2023 tax year. Quickly figure your 2021 tax by entering your filing status and income.

Ontario Basic Personal Amount. Based on your projected tax withholding for the year we can also estimate your tax refund or. This calculator is for the tax year 2022 which is payable in april of 2023.

Tax tables that continue to apply from 1 July 2022 About tax tables We produce a range of tax tables to help you work out how much to withhold from payments you make to your employees. This BIR Tax Calculator helps you easily compute your income tax add up your monthly contributions and give you your total net monthly income. Calculate your 2021 tax.

The top marginal income tax rate. Federal Basic Personal Amount. Do not use the calculator for 540 2EZ or prior tax years.

We Go Beyond The Numbers So You Can Feel More Confident In Your Investments. Income Tax Rates and Thresholds Annual Tax Rate. Visit The Official Edward Jones Site.

Date of last pay rise. Ad An Edward Jones Financial Advisor Can Partner Through Lifes MomentsGet Started Today. 2022 Tax Calculator 01 March 2021 - 28 February 2022 Parameters Period Daily Weekly Monthly Yearly Periods worked Age.

Get savvy with. Kenya PAYE Calculator with Income Tax Rates Of January 2022 Calculate KRA PAYE Net Pay NHIF NSSF. Based on your annual taxable income and filing status your tax bracket.

Online income tax calculator for the 2022 tax year. Estimate Your Taxes and Refunds Easily With This Free Tax Calculator from AARP. Income tax is calculated.

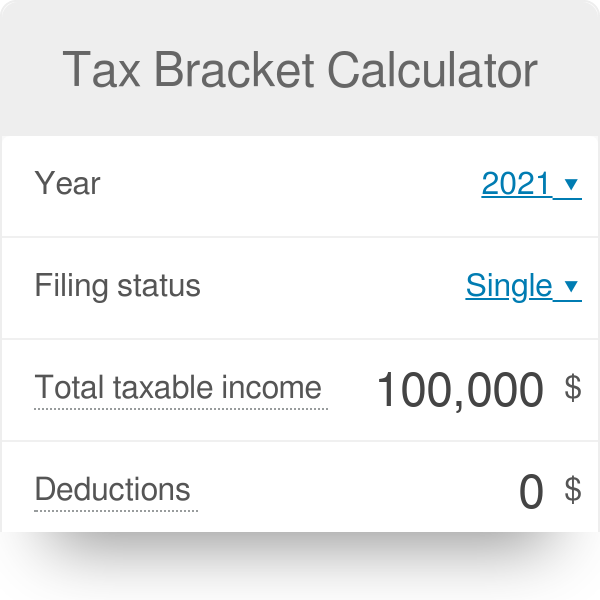

2022 Income Tax in Canada is. Use our Tax Bracket Calculator to answer what tax bracket am I in for your 2021-2022 federal income taxes. This tax calculator will be updated during 2022 as new 2022 IRS tax return data becomes available.

Your income could include. This is made clear in the calculations when using the Jamaica tax calculator for 2022. If you are paying pension income use the Payroll Deductions Online Calculator to find the tax deduction.

Income Tax in Malaysia in 2022 Taxes including personal income tax. Our free tax calculator is a great way to learn about your tax situation and plan ahead. Ad Enter Your Status Income Deductions and Credits and Estimate Your Total Taxes.

Jamaica Residents Income Tax Tables in 2022. Your personal salary and tax calculations see the table below for a full breakdown and. Ontario Personal Income Tax Brackets and Tax Rates in 2022.

Tax calculator is for 2021 tax year only. How is income tax calculated in 2022. The Tax tables below include the tax rates thresholds and allowances included in the Malaysia Tax Calculator 2022.

You can also create your new 2022 W-4 at the end of the tool on the tax. 10 percent 12 percent 22 percent 24 percent 32 percent 35 percent and 37 percent. The 2022 Tax Year in Canada runs from January 2022 to December 2022 with individual tax returns due no later than the following April 30 th 2023.

2022 New Mexico Sales Tax Table. Personal amounts The federal personal amounts for 2022 are. Ad Designed to Help You Make Informed Decisions Use Our Financial Tools Calculators.

The Tax Caculator Philipines 2022 is. The California State Tax Tables for 2022 displayed on this page are provided in support of the 2022 US Tax Calculator and the dedicated 2022 California State Tax Calculator. Estimate your federal income tax withholding See how your refund take-home pay or tax due are affected by withholding amount Choose an estimated withholding amount that.

The rates are based on your total income for the tax year. Age Amount Tax Credit 65 years of. There are seven federal income tax rates in 2022.

Enter your filing status income deductions and credits and we will estimate your total taxes. A Work and Income.

How To Calculate Federal Income Tax

2021 2022 Federal Income Tax Brackets Tax Rates Nerdwallet

2022 Income Tax Withholding Tables Changes Examples

Tax Calculator Estimate Your Income Tax For 2022 Free

What Is My Tax Bracket 2021 2022 Federal Tax Brackets Forbes Advisor

How To Calculate Income Tax In Excel

Tax Bracket Calculator

Tax Calculator Philippines 2022

Free Tax Estimate Excel Spreadsheet For 2019 2020 2021 Download

How To Calculate Payroll Taxes Methods Examples More

2021 2022 Federal Income Tax Brackets Tax Rates Nerdwallet

Irs Announces 2022 Tax Rates Standard Deduction Amounts And More

Excel Formula Income Tax Bracket Calculation Exceljet

How To Fill Out A W4 2022 W4 Guide Gusto

Budget Income Tax Slabs Proposed 2022 2023 Salary Tax Calculator

Effective Tax Rate Formula Calculator Excel Template

How To Calculate Federal Income Tax