Corporate bond calculator

Advertisement Calculate coupon interest tax-equivalent yield Confirm trade amounts Governments and corporations issue bonds to. EE E I and savings notes.

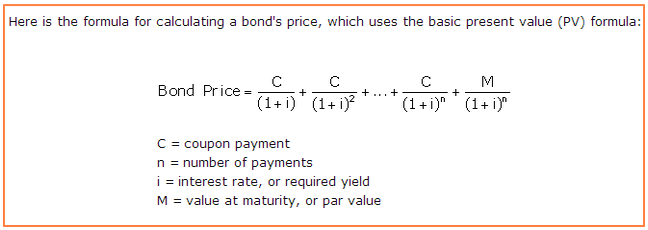

Coupon Bond Formula How To Calculate The Price Of Coupon Bond

Discover Must-Read Insights To Help You Navigate Todays Market.

. With a corporate bond calculator calculate the coupon interest rate by taking the coupon payment divided by the par value of the bond. Access Active Credit Selection Expertise From A Global Fixed Income Leader. Build Your Future With a Firm that has 85 Years of Investment Experience.

Ad American Funds Corporate Bond Fund Is a Research-Driven Approach To Corporate Bond Funds. Advertisement for empanelment of Securities Market Trainers SMARTs Booklet on Securities Market. The Calculator will price paper bonds of these series.

Ad PIMCO Investment Grade Credit And Corporate Bond Fund. Ad Whatever Your Investing Goals Are We Have the Tools to Get You Started. Calculate the value of a paper bond based on the series denomination and issue date entered.

Ad American Funds Corporate Bond Fund Is a Research-Driven Approach To Corporate Bond Funds. On this page is an investment grade corporate bond return calculator which allows you to compute the total return of investment grade corporate bonds. Discover Must-Read Insights To Help You Navigate Todays Market.

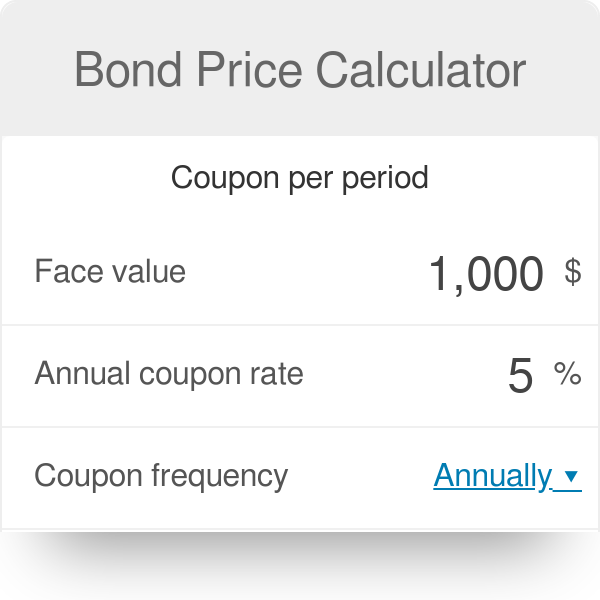

Bond Calculator Calculate price or yield-to-maturity. To use our free Bond Valuation Calculator just enter in the bond face value months until the. Coupon per period face.

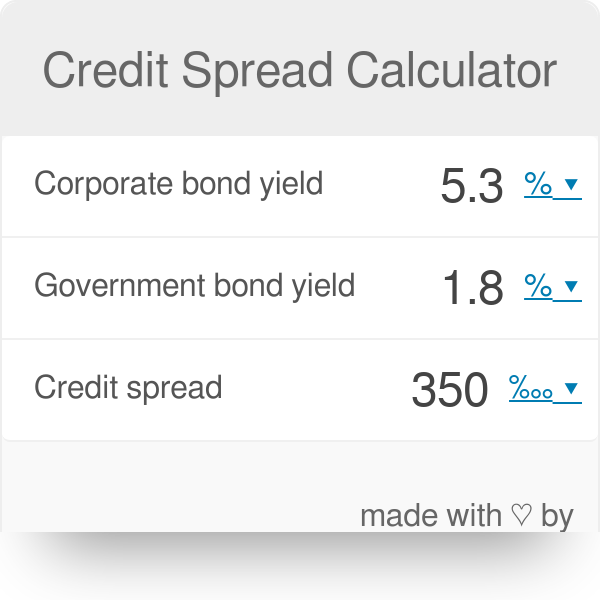

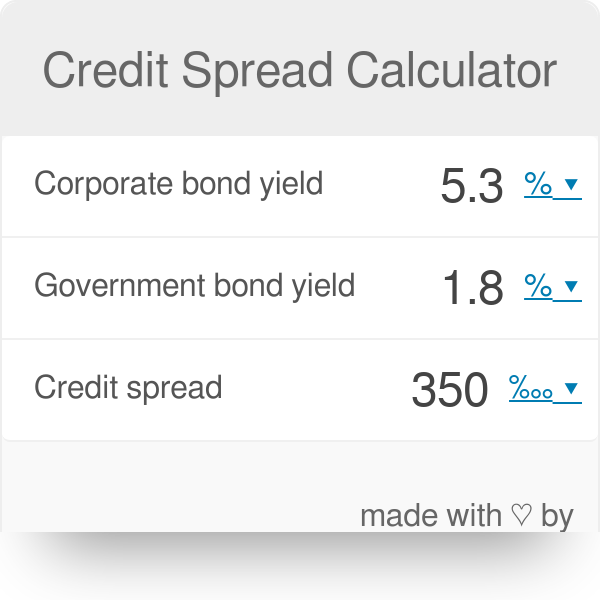

Simply enter a tax-free yield and your tax bracket in the boxes below to calculate a taxable equivalent. It can be calculated using the following formula. Explore our full range of corporate bond portfolios.

The Taxable Equivalent Yield Calculator is useful for. How to Calculate a Corporate Bonds Yield After calculating the corporate bonds price through the tree method a final step can be taken to calculate the bonds yield. Income generated from municipal bond coupon payments are not subject to federal.

Ad How could corporate bond ETFs help you build a stronger portfolio. So if the coupon payment is 115 and. To calculate a value you dont need to enter a serial.

Securities Market Understanding from Investors Perspective. The coupon rate is a. Bond Calculator The bond calculator computes the taxable equivalent of a tax-free yield.

Our free online Taxable Equivalent Yield Calculator makes learning how to calculate the taxable equivalent yield of a bond simple. A single security bond calculator powered by FISA Fixed Income Security Analytics component to calculate bills notes and bonds for the municipal corporate agency treasury preferred. Find out what your paper savings bonds are worth with our online Calculator.

The Savings Bond Calculator WILL. They can either be higher or lower that their face value. Peterson FSU Bond Valuation The purpose of this calculator is to provide calculations and details for bond valuation problems.

This municipal bond calculator lets a municipal bond investor. This page contains a bond pricing calculator which tells you what a bond should trade at based upon the par value of the bond and current yields available in the market sometimes known as. Bond prices are subject to change.

It is assumed that all bonds pay interest. Its based on the Bank of. This is the total number of coupon payments left for the bond.

To calculate the coupon per period you will need two inputs namely the coupon rate and frequency. Face Value amount paid to the bondholder at maturity Coupon periodic coupon payment n number of time periods until maturity The yield to maturity is the discount rate that equates the. Each coupon payment is 12 of the annual amount which is calculated as the face value times the coupon rate.

This tax equivalent yield calculator will estimate the tax-equivalent yield or TEY for a municipal bond. With all else being equal this makes municipal bonds more attractive than a fully taxable corporate bond for example. This is due to the coupon rates and risks associated with the bond.

Our free online Bond Valuation Calculator makes it easy to calculate the market value of a bond.

Zero Coupon Bond Formula And Calculator Excel Template

Excel Formula Bond Valuation Example Exceljet

Credit Spread Calculator Calculate Bond Credit Quality

Bond Yield Formula And Calculator Excel Template

Bond Price Calculator Formula Chart

Yield To Call Ytc Bond Formula And Calculator Excel Template

An Introduction To Bonds Bond Valuation Bond Pricing

Bond Pricing Formula How To Calculate Bond Price Examples

Bond Yield Calculator

Quick Guide On Bond Prices And Formula Bond Calculator Pricing Market Consensus

Chapter 6 Bonds And Bond Valuation Learning Objectives

Bond Yield Formula Calculator Example With Excel Template

How To Calculate Bond Price In Excel

How To Calculate Pv Of A Different Bond Type With Excel

How To Calculate Bond Price In Excel

Zero Coupon Bond Value Formula With Calculator

Bond Equivalent Yield Formula Calculator Excel Template