26+ Compound interest mortgage

When compounding occurs the interest is added to the amount owed. Learn more about compound interest here.

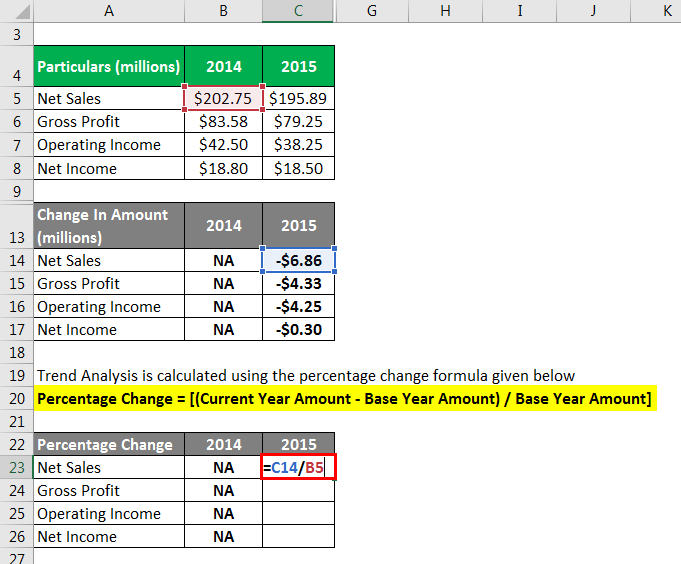

Trend Analysis Formula Calculator Example With Excel Template

110 10 1.

. The interest on a loan or deposit calculated based on both the initial amount and previous interest payments from previous periods is known as compound interest or compounding. A typical home mortgage is still a simple interest loan even though it feels like compound interest. Compound interest and your mortgage.

The compound interest of the second year is calculated based on the balance of 110 instead of the principal of 100. Now suppose you take out the same loan with the same terms but the interest is compounded annually. The formula is as follows.

Mortgages are how most people are able to. In the first year the interest rate of 10 is calculated only from the. At a 2 annual interest the total interest would be 1049214 which is more than twice that of a 1 mortgage loan thanks to compounding interest.

How to calculate compound interest. Total amount B 400000 x 1 00312 12 x 30 Therefore the total mortgage payments equal 98273688. The compounding feel comes from varying principal payments.

That said the higher the rate or the. To work out how much you would pay each year or month. Mortgages dont do that because the total amount of interest due is already calculated beforehand and can be displayed via an mortgage amortization schedule.

Amount that you plan to add to the principal every month or a negative number for the amount that you plan to withdraw every month. The calculator will use the equations. R n AP 1nt - 1 and R r100.

In the US the most common mortgage loan is the conventional 30-year fixed-interest loan which represents 70 to 90 of all mortgages. Inventory Valuation Methods Types Advantages And Disadvantages Finally continuously compounding interest grows at the. Compound interest helps you save more faster.

A relatively straightforward mathematical formula can be used to calculate the total sum of compound interest that will be paid on a mortgage loan. Compounded interest is compounded daily monthly or annually. Toggle Navigation 888 452-0335 Apply Now.

Thus the interest of the second year would come out to. Compound interest investors and mortgage borrowers have something in common. 888 474-0404 Licensed by.

Mortgage interest in Canada is compounded semi-annually. So youd need to put 30000 into a savings account that pays a. They are both rate hunters who keep an eye on the market for conditions they can take advantage of.

It can provide lower interest. The small 1000 loan version over five years given in our example showed a saving of almost 200 close to 20 of the principle. In the calculator above select Calculate Rate R.

This means that while you might be making monthly mortgage payments your mortgage interest will only be.

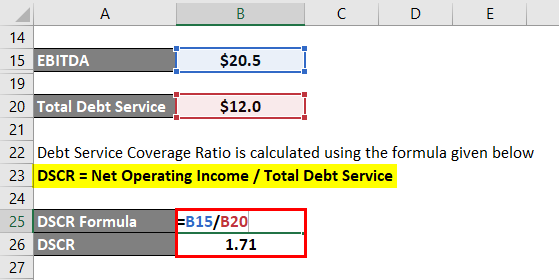

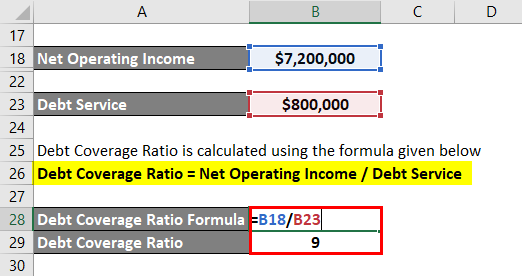

Debt Service Coverage Ratio Calculate Dscr With Practical Examples

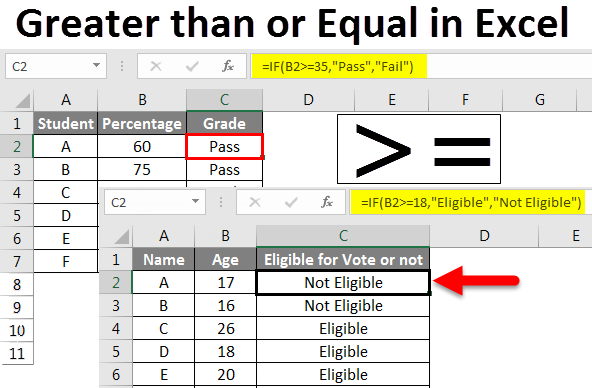

Greater Than Or Equal In Excel Uses Of Greater Than Or Equal In Excel

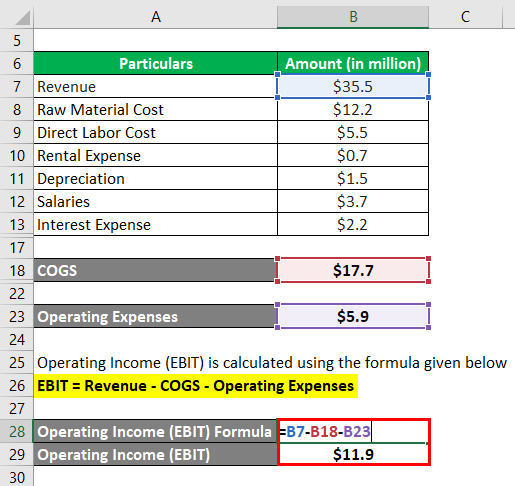

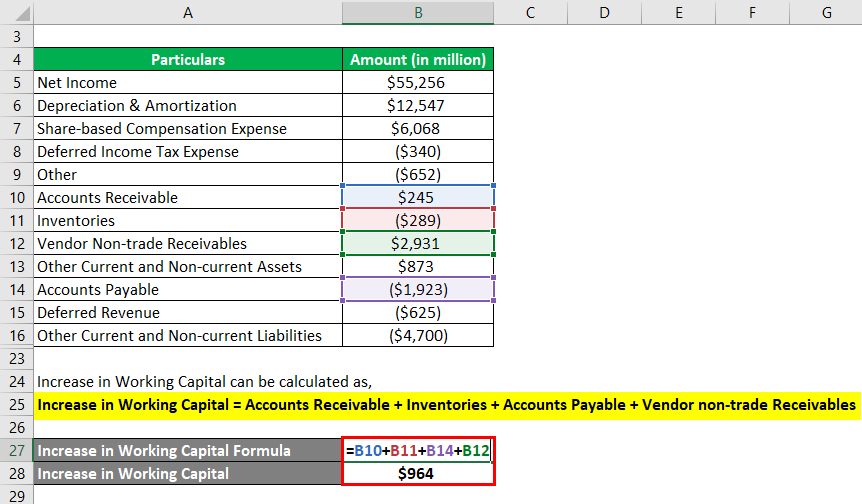

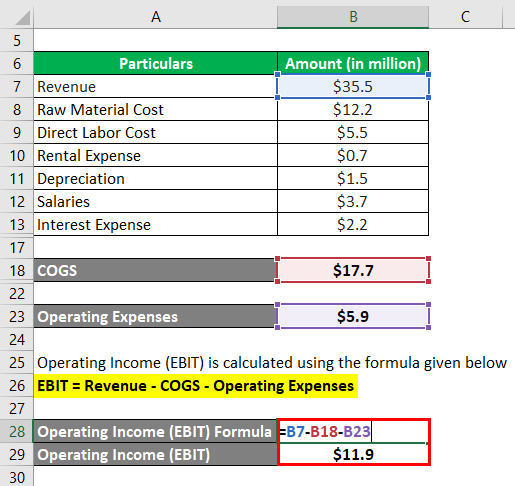

Operating Cash Flow Formula Examples With Excel Template Calculator

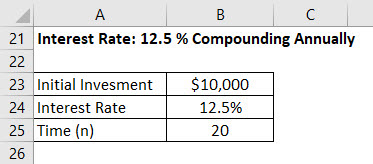

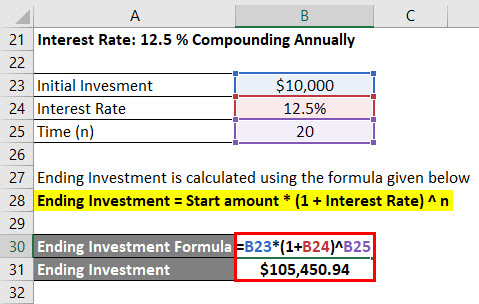

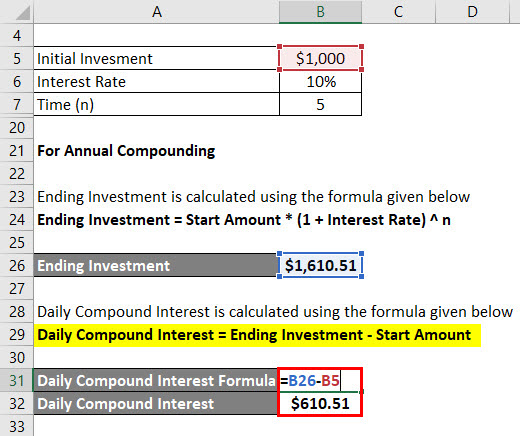

Daily Compound Interest Formula Calculator Excel Template

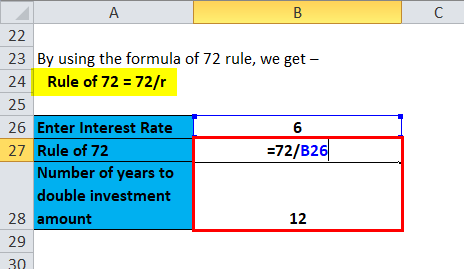

Rule Of 72 Formula Calculator With Excel Template

Free 6 Sample Agreements For Labour Contract Templates In Ms Word Pdf Contract Template Contract Agreement Ms Word

Daily Compound Interest Formula Calculator Excel Template

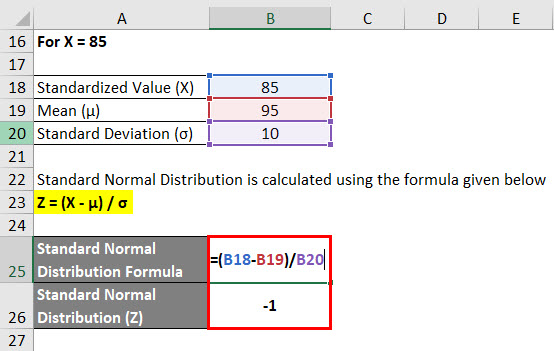

Standard Normal Distribution Formula Calculator Excel Template

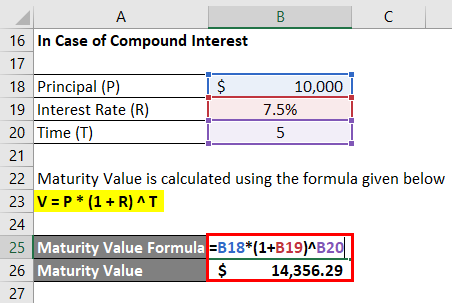

Maturity Value Formula Calculator Excel Template

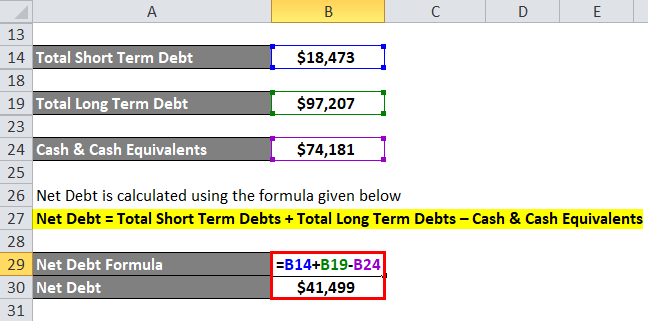

Net Debt Formula Calculator With Excel Template

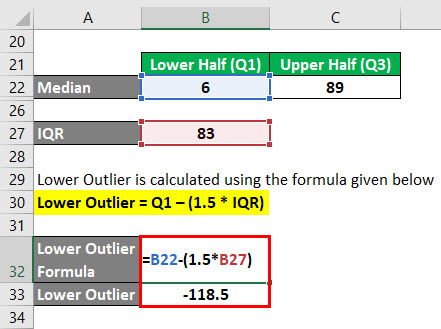

Outliers Formula How To Calculate Outliers Excel Template

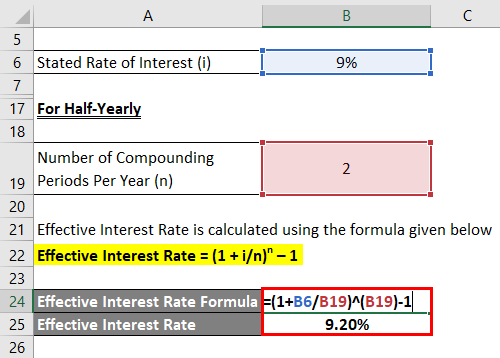

Effective Interest Rate Formula Calculator With Excel Template

Maturity Value Formula Calculator Excel Template

Interest Coverage Ratio Formula Examples Of Interest Coverage Ratio

Cash Flow Formula How To Calculate Cash Flow With Examples

Daily Compound Interest Formula Calculator Excel Template

Debt Coverage Ratio Example And Importance Of Debt Coverage Ratio